Strategic Business Financial Approach

Furthermore, Morningstar reports that the number of sustainable funds offered to United States investors at the end of 2018 revealed a 49% boost (an overall of 351 funds) over the last 12 months (Hale 2019) (conspiracy commit securities). The main point dividing the lovers from the doubters is whether Impact Investing is additive to efficiency or not.

This study like others concentrates on SRI techniques with exclusionary screens. In a different way, research on strategies integrating ESG and sustainability factors based on their financial or investment benefits reveals a different photo: companies with high rankings for CSR and ESG have a lower cost of capital in terms of financial obligation and equity; companies with high ESG scores display market-based outperformance in addition to accounting-based outperformance.

In other words, the drivers of the impact are incorporated into producing the above-market return. Furthermore, Impact investing 2.0 is based on understanding the future implications of social and economic shifts that are producing financial investment opportunities typically missed by other investors. For instance, many people agree that climate change is occurring; nevertheless, many investors view it as a far-off issue and not a priority in their investment programs.

This is not a too far-off problem as Cape Town, South Africa, just recently experienced a major drought and came close to what observers were calling Day Zero – opportunities fund private. Business that own water purification innovations are only one kind of financial investment that could be in high need as the world handles these new conditions.

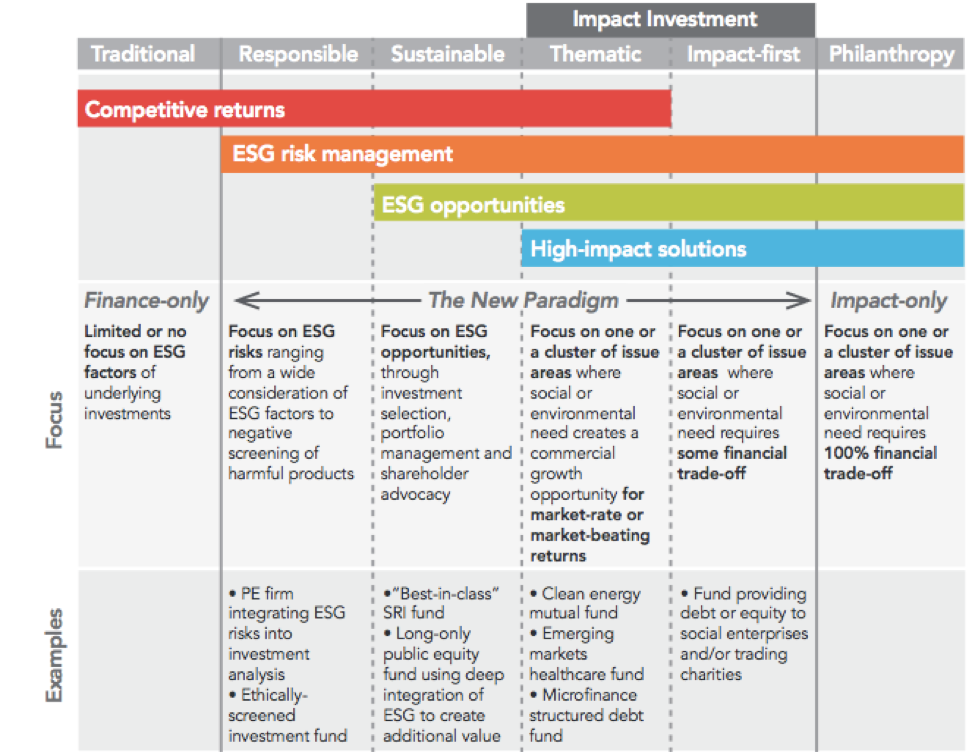

The author also clarifies what Impact Investing is NOT: it is not values-based investing with numerous developments in integrating one’s worths into a portfolio without including substantial levels of risk. As gone over previously, given that there is no financial or monetary chauffeur encouraging this activity, it falls under more of an SRI approach.

Tyler Tysdal Business

What was once considered a one-off investment technique now has its own department at numerous of the most prestigious financial investment organizations. This post does an excellent task of defying what it is and what to search for in due diligence processes. As far as the due diligence procedure, a good primary step to incorporating impact investing 2.0 into a financial investment program is to examine the current holdings.

However it is essential to keep in mind to look behind those rankings and comprehend the rationale of the holding. Just as with any accounting metric, it is useful to understand how the number is obtained. Do not simply take a sustainability metric at face worth. An effective analyst does not do that.

Indexes are unmanaged and do not reflect management or trading costs, and one can not invest directly in an index. lone tree lone. Impact investing is a rapidly developing fielddepending on the kind of investors asked, they will offer a variety of definitions and expectations. Much of the field has derived from philanthropic roots; nevertheless, the latest advancements are driven by an investment point of view.

Astute investors understand that incorporating sustainability and environmental, social, and governance (ESG) aspects into their analysis will frequently boost long-lasting returns. Numerous of these impact-oriented patterns are neglected or underestimated by conventional investors, leaving an investment opportunity for those ahead of the curve. Before discussing the monetary applications to impact investing, the article provides an introduction of impact investing and its two diverse evolutionary courses, in addition to differing return and impact expectations.

Regardless of continuous international economic unpredictability, major institutional investors remain concentrated on both the social and ecological impact of their strategies. undisclosed monitoring fees Tysdal. The world’s largest sovereign wealth fund, Norges, in May divested from 12 business that check out for oil and gas. While the relocation is said to be primarily encouraged by the fund’s method to shield itself from a long-lasting fall in oil prices, it follows a larger belief shift far from fossil fuel producers in line with a growing acknowledgment of the impact of climate modification.

Quarterback Carson Palmer

” The existing crisis is refocusing decision-making on the sustainability of investment opportunities and on constructing more durable portfolios to protect versus future crises such as climate modification” he states. “However terrific the uncertainty surrounding the present crisis, a longer-term focus on impact financial investment stays. Tysdal denver business.” With widespread monetary stimulus plans developed to support economies through the pandemic, there will be substantial opportunities for responsible investment strategies that seek to construct a much better future and a sustainable healing as the world slowly re-opens for business, states Romano.

While the trend is still in its infancy, with impact-dedicated funds still accounting for less than 1 percent of global investment, momentum is constructing. At the start of this year, BlackRock the world’s biggest property manager stated it is looking for a tenfold boost in sustainable financial investments over the coming decade in a move that rocked the market.

More just recently, an IPE study of genuine estate investors performed between 2 March and 8 April 2020, and particularly about the coronavirus crisis from 17 March discovered that a person in 5 are continuing to make social impact financial investments while an additional one in 3 are preparing or seriously considering it in the future. johns creek georgia.

Making the numbers work is key for this to resonate with the larger market, says Romano. “The focus for investors on impact opportunities stays mostly on potential for enhanced, risk-adjusted returns, in resistant property,” he states. It’s early days, however there is some proof that ESG-linked funds can outperform.

” Considerable development in impact investing is possibly on the cards,” says Romano. “If investors can genuinely see the benefits over the long-term then one can expect things to accelerate in the coming years.” Click to discover 4 ways green thinking can add worth for investors..

Private Equity Real

The Impact Opportunities Fund allows choose investors to make the most of opportunity by buying the debt and equity of personal companies with the outcome of above market returns for the underlying danger. The Impact Opportunities Fund enables choose investors to make the most of opportunity by investing in the financial obligation and equity of personal business with the outcome of above market returns for the underlying risk.

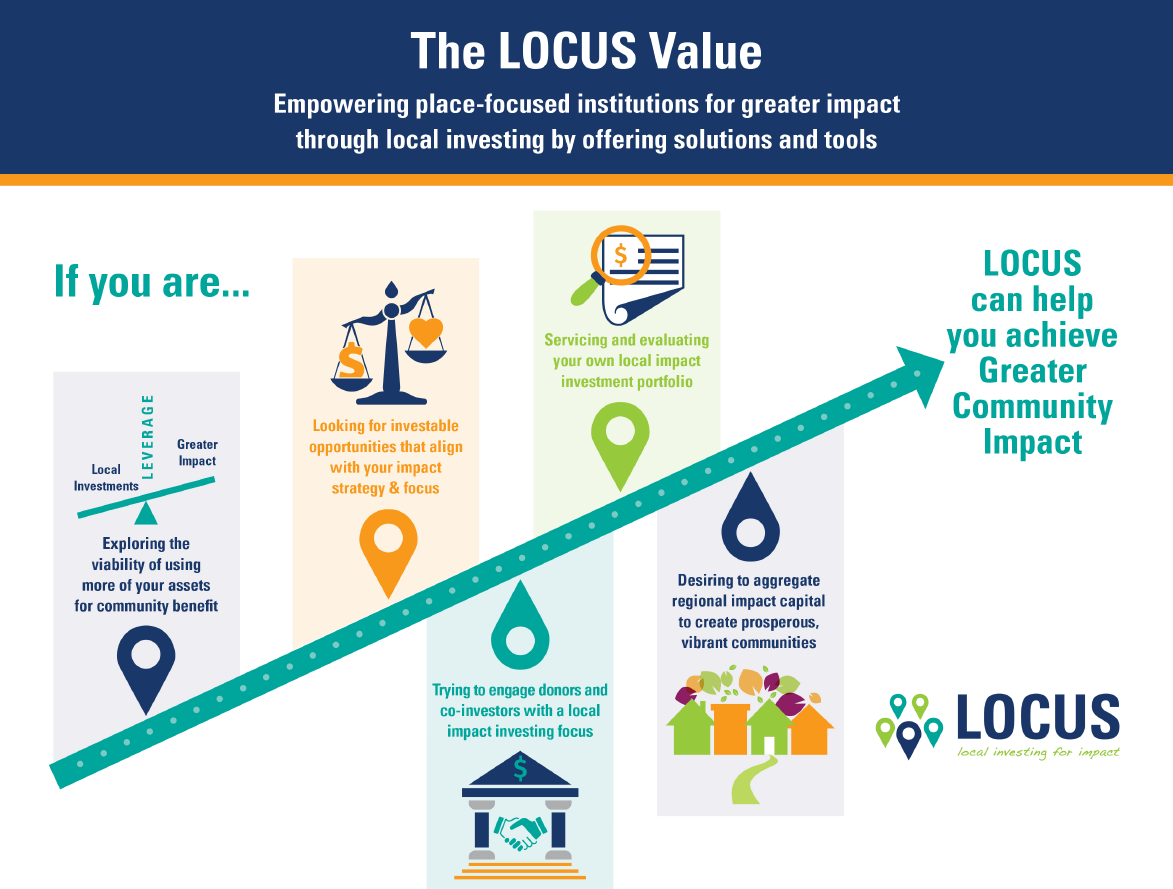

The Case Structure, in partnership with ImpactSpace and Crunchbase, is establishing the Impact Investing Network Map to show the connections in between investors, companies and funds within Impact Investing. Our company believe bringing the connections in between investors and companies to life will foster a better understanding of the size, breadth and depth of the impact investing community.

The Beta variation of the Network Map, will catalyze field-wide efforts to break down information barriers to create the essential on-ramps for all, to advance the growth of the Impact Investing field – investors claim Tysdal. We use the meaning of Impact Investing supplied by the International Impact Investing Network (GIIN): “investments made into companies, companies and funds with the objective to create social and ecological impact along with a monetary return.

The Network Map aims to highlight the chance to create a burgeoning impact financial investment market with billions of dollars streaming into thousands of deals. We have developed a data-powered visualization of international impact financial investments matched with preliminary insights. Using a system of filters, users can sift through thousands of data points.